Table of Contents

Everyone should enjoy financial freedom in their earning life. Spending money on their needs and extravagant lifestyle. But the leading life in metropolitan city curbs all this freedom.

Because the salary is not enough to lead a decent lifestyle. Earing 20K to 30K is not enough to satisfy our desire and cannot maintain family elegantly.

To lead a comfortable lifestyle one needs a Credit Card. Banks provide credit cards to earning individuals.

As the name suggest credit card posses money that an individual can spend in a limited manner. Then the individual should repay the debt in a specified time. Otherwise, he is been levied by interest and hidden charges.

So to help these credit card holders and completely change the ecosystem of credit card bill payments Cred was started.

Cred made the bill payments fancy and less risky. Now pay the credit card payments became like an enthusiastic task. Because it offers valuable returns.

In this article, you learn about the platform Cred and how it revolutionized the credit card system.

Cred startup story

Cred is a fintech company. These platforms allow users to pay their credit card bills. In return, the user gets cred coins where user can use to buy products available on the platform.

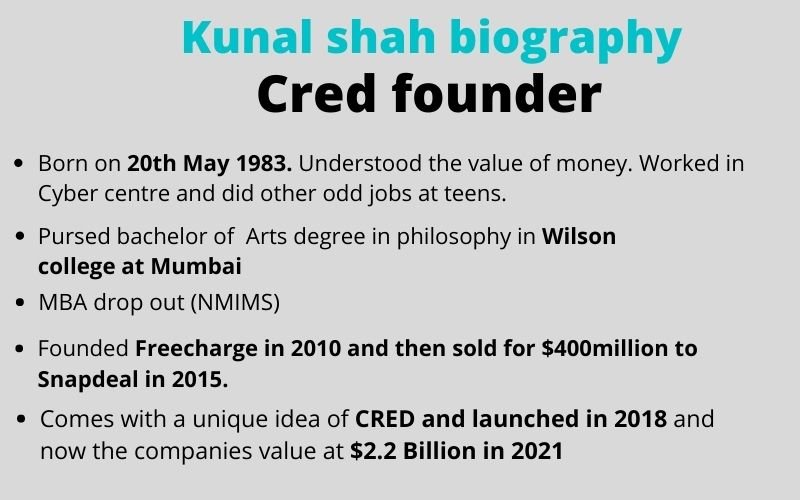

The company was founded by Kunal Shah in April 2018. These platforms remind the user to pay their bills through messages. So Cred saves users from paying extra interest due to negligence or forgetfulness.

Cred is a reputed company and gives high priority to loyal customers. So the person who has a credit card score of more than 750 points is allowed to use cred.

Cred valuation is $2.2 billion and became a unicorn in less than 2 years. There are around 10 million users of Cred in 2021.

Also read: paytm success story

How Cred credit card company founded

Founder of Cred Kunal Shah builds this platform to create a trustworthy environment. Kunal Shah observed unusual behavior in credit card bill payments. Cred startup story have changed the credit card game.

He also found that owning a credit card is regarded as risky. Getting a credit card in India is easy but the still majority refuses to buy.

There are only 52 million credit card users in India. To get a close look only 3 in 100 people own a credit card. Kunal shah was desperately wanted to tackle this problem.

He also understood the problems of credit card users in India

- High rate of interest

- Unnecessary hidden charges

- Annual maintenance charges

- Different banks have the unique rate of interest

People are just fed up with interest and unfair charges. Here is an interest rate of banks

| Bank name | Interest rate pre month |

| HDFC | 3.49% |

| American Express | 3.4% |

| SBI | 3.35% |

| ICIC | 3.4% |

| Citi | 3.4% |

| Bank of Baroda | 3.5% |

Kunal Shah observed loyal customers are not getting the benefits. Moreover, there is no difference between loyal and insolvent customers.

Kunal wanted to respect and provide loyal customers a lot of benefits. Further, he aims to increase users of credit cards.

Finally, he created the platform Cred in 2018 where Credit card users get amazing rewards on paying their bills.

The only motive of the company is to build a good and healthier ecosystem. Payback to loyal customers.

Also read : warren buffet succesful investor

How to use Cred credit card : Cred startup story

Using Cred is as simple as that. Download the Cred app. It is available in both IOS and android, Then enter your credit card details and mobile number. Instantly you will become a cred member.

The individual who has 750+ points are entitled to use the platform. Otherwise, you will be put on a waiting list.

After becoming a Cred member no one forgets their credit card bill payments. It sends frequent reminders for its users.

On paying the bills users get cred coins where they convert into money by using “Kill the bill” options. Then users can purchase on its platform.

So its users are entitled to a lot of benefits.

Cred Mint P2P lending product : Cred startup story

Cred credit card-based innovation platform once again came out with stunning product into the product Cred Mint.

Itis a fintech startup that rewards credit card users by giving cred coins. This platform is there only for creditworthy customers whose scores are more than 750 points.

Now, the company started its innovation in its platform. Now cred users can lend money to another user in the community and can earn 9% interest on it.

So, the lender can get more return on the investment. This interest is more the inflation rate of India of 6.626%. Cred till now lend loans worth 12,000 crores to its users in the last 12 months.

So the company understands the need for money. As a result, the company thought to diversify the amount of its user’s money in the platform.

The company has partnered with Liquilons, an RBI registered P2P lending non-banking financial company. This partnership helps to regulate the new products Cred Mint

Features of Mint

In this P2P lending product Cred Mind, users can lend money between 1 lakh to 10 lakh. Prior, the users have to register to the Cred Mint scheme in the app.

Then the user investment is lent to 200+ borrowers. The company offers loans only for creditworthy customers to build a trustworthy platform. Cred startup story is bringing new features.

Here are some of the Essential features of Cred Mint

- The lender can withdraw money at any time partially or the whole sum

- Then Lender is not liable to any penalty for withdrawing the money

- Still, the investor gets the interest depending on the duration

- The whole process is fully transparent, where the lender can track their investments in the app.

This is a good move from the startup. Now the company is bringing innovative ideas into its platform. Now the users can get 9% of interest on their investments. Anyone can’t get even on their FDs. Therefore, this is a good opportunity for the users to invest in Cred Mint products.

Cred startup story is example of great idea.

Cred Business model

Cred is a fintech company so it earns through charging a commission transactions fee.

- Rent pay: It is one of the features of the company. It reminds its users to pay rent through credit cards. It charges some transactions free on this.

- Brands products: The platforms lot of attractive products. It has almost 1300 brands on its platforms. Users are allowed to redeems their cred coins and buy the products with the fewer amount. So here it charges commission on its sales.

- Data: Currently the company has almost 10 million loyal credit card users’ details. So in the future, it might share these details with other banks on making financial deals.

- Loans: They provide personal loans to their users with a paperless process.Loan amount up to 5 lakh. In the future, it earns through interest paid by its users.

Cred Credit card Ads campaigns

To promote a brand marketing is a very essential step. Cred realized this process and executed it supremely. They have used the right ad strategies.

The company featured the stars of the late 1990s to target its credit card users. Avg age of credit card users is 35. So the audience might get attracted to their old admiring stars.

Till now cred ads featured Kumar Sanu, Madhuri Dixit, Rahul Dravid, Anil Kapoor, Jackie Shroff, Govinda Ahuja, Bappi Lahiri, Daler Mehini, Alka Yagni, Jim Sarbh, and Udit Narayan.

Its ads campaigns tagline are ” download cred” and “not everyone gets it.

Cred is also is officially a partner of IPL for 2 years 2020-22 with a 120 crore deal. It is a complete feast for fans because the company comes with hilarious ads for every new edition.

As latest funny ad featured Rahul Dravid. Where lose his temper in the traffic jam and calls himself has an Indiranagar Goonda.

Cred financial model : Cred startup story

Cred has become a unicorn within two years of its launch. Fundings are coming everywhere.

But the company fails to become profitable till now. The company incurred a 63.9 crore loss in FY19 with zero income.

In the upcoming year also faced the loss of about 378 crores and with only 52 lakh working income. Cred spends 727 rupees to get 1 rupee as income.

So every investor is keen to look into profits in future.

Fundings

Cred received funds before its launch. Because of founder Kunal Shah’s leadership and success.

In early Jan 2021, Itraised 80 million with taking the company to $804 million in valuations.

Recently it got huge funding of $215 million from Falcon Edge Capital. Now company values at $2.2 billion.

There are a lot of investors who are part of the company like

- Tiger Global

- DST Global

- Sofian

- Insight Partners

- RTP Global

Cred startup funding

In the Series F round of funding, the cred startup has raised over $80 million. The major investor in this round of funding is the GIC of Singapore. Even other investors like tiger global, alpha wave Global, Sofina venture, and Dragoneer.

Currently, in 2022, many startups are not receiving findings from the VCs. As a result startups like Unacademy, Vedantu, Cars24, Meesho, and Mfine. According to the Inc42 report, over 9200 employees have been laid off till now.

But on the other hand, the current startup is receiving funding even though it has not become profitable yet. The main reason for the funding because of the founder Kunal Shah. Now present valuation of Cred is over$ 6.5 billion dollars. It is one of the top ten valuable startups in India.

Cred revenue in 2021 is over 95 crores. But the losses have surged over 523 crores. But Cred startups have unique ideas and execution in the future. It believes that it is going to be profitable in the future. Many investors are investing at Cred because of Kunal Shah’s past achievements. Cred startup funding is taking no stop as like other startups.

Previously, Cred startup has raised $ 251 million in its series d and another$ 251 million in its series E funding round.

The company has huge potential to grow very big in the future. It has also seen a huge increase in credit card users in the last three years from 18 million to 52 million.

During the pandemic, people are in desperate need of money. So Cred might take advantage of the situation and might earn revenue.

Cred UPI Services 2022

Cred it’s known for its cred coins where users get paid by paying credit card bills. But now Cred started with its UPI Service. Till now any credit user can only earn Cred coins and can redeem them to buy products.

But now anyone can pay using Cred App. So it is simple like other apps such as Paytm, Phonepe, and google pay.

There is a significant amount of increase in UPI in services in India. Now Cred startup makes using this opportunity to expand its user base.

Cred users get cashbacks and rewards after making a payment. So it is a good time for customers to gain some rewards.

This way, Cred startup is integrating UPI services into its platform. So for the Cred users, it is not necessary to install another UPI-based app.

Cred 2022 Revenue: Cred Latest news

Cred credit card payment startup is once again in news. This time Cred Startup has published its financial results for 2022.

The most anticipated startup, Cred revenue 2022 jumped over 4x and made 393 crores. Previously Cred Revenue in 2021 was merely 89 crores. Now, this startup is growing its user base and also its revenue.

As we all know Cred startup is aggressively spending on its marketing. Many have you have witnessed about most exciting Cred ads in and around IPL.

Besides its 4x revenue growth, Cred losses in 2022 piled up over 1,279 crores. So the marketing expenses were the major contribution to losses which was over 973 crores.

Presently, Cred startup e is not earning with credit card payments. Instead, Cred is earning with the two of its services

“CRED MINT” is P2P lending.

Another source of earnings for Cred is from the D2C brand’s commission in its app. Whenever a user purchases a product from the brand which is listed in the Cred app, some piece of money will go to Cred as a commission.

Cred valuation in 2022 stands out at over $6.4 billion. The major investors are Tiger Global, Flacon Edge, DST Global, and Insight Partners.

Even Cred acquired two companies HipBar which is a liquor delivery startup based out of Chennai. Then another one is Happay an expense management app.

So in the future, Cred is going to be a massive data holder of credit card users. There is a massive opportunity for the Cred startup to monetize its platform.

Therefore we have to wait for the mastermind behind Cred, Kunal Shah’s next move.